Understanding ESG is the difference between success and failure when it comes to investing. It simply cannot be ignored anymore. Whether you are an investor or a company, big or small – Environmental, Social and Governance (ESG) reporting and investing is vital to understand if you want to stay up to speed with the market and current trends.

Get a foundational understanding of ESG in this free training session

Conscious consumerism is growing exponentially worldwide. On the back of the pandemic, regulatory pressure and client demands, many organisations have responded by announcing net-zero or carbon-neutral commitments and investing in climate action. With this growing alertness globally, adopting ESG measures has transformed the priorities for many organisations. It is important that the finance industry moves fast towards fulfilling those requirements to reach the next level of investment capacity.

This Certificate in ESG Investing course will give a deeper understanding of ESG, its growth, the implications, and the variety of ESG integration. It is designed for investment practitioners of all levels who want to learn how to analyse and integrate material ESG factors. You may be looking to start your career or working in sales & distribution, asset management, product development, financial advice, consulting, or risk. Wherever you are coming from, this course will drastically improve your understanding of ESG issues in an intuitive, informative, and engaging environment.

The Certificate in ESG Investing is administered and awarded by the CFA institute and can be booked here. It is assessed through online testing using multiple choice and item set questions. Exams are delivered globally through various testing centres and virtual options are also available depending on region.

This unique and practical qualification gives you a competitive edge and career advantage in this vastly growing field. This course in ESG with Echios is mapped specifically to the CFA certificate in ESG Investing exam and will act as a direct revision tool to assist you to success. Our prompts, revision tools and question bank are precisely the material you need to feel fully prepared and equipped.

Clients are demanding more than ever for responsible investing to be integrated into their portfolios. Whilst it has become a priority now, it is not a new concept. By completing this course, you will better understand the story and growth of ESG which is essential to understanding the future of it.

Terms such as sustainable investments, thematic investments, or impact investments describe the variation of ESG investments. However, they all relate to the rippling effect of ESG factors. This part of the course will help to better understand the trends and the effect that they have on the market.

To be ahead of the trend, it is vital to understand the many layers to ESG investment. This course will delve into how ESG considerations are relevant within setting investment objectives, deciding on asset allocation, investment management, reporting and at a research level. Understanding these distinctions will give you deep insight into the world of ESG and how it facilitates top line growth.

Our unique training is delivered by our ESG experts and contains all you need to know to get ahead in this field. You can watch and rewatch the sessions, allowing it to work around your schedule. Our videos are delivered in short sharp bursts meaning that the content is easily digestible and actionable straight away. You will have the opportunity to ask questions via our help desk which is linked directly to our tutors.

Whatever stage of your ESG understanding, this course manages to break down complex ideas into easily digestible and useful information that you can use immediately. The videos are carefully designed with question prompts and assessment tools so that you are embedding the learning as you go to ensure you finish feeling confident.

This course is for anyone with an interest in ESG to enhance your understanding, but it is also designed in a way that is directly mapped to the CFA certificate in ESG and helps with preparation for that exam. You will be provided with a workbook, a question bank of over 600 questions and mock exams to ensure that you are completely prepared.

This course is specifically designed to equip you with all you need to know about ESG investing. This is a highly detailed, highly structed and interactive programme. With our continuing assessments and engaging online content, you will feel confident and knowledgeable in the world of ESG and make an impact in your work. If studying for the exam, this is the exact preparation you will need. All videos and content will be made available to you for you to learn at your own pace, anytime, anywhere. We are so confident in our content that we guarantee your success on the ESG exam and will continue to support you until you pass.

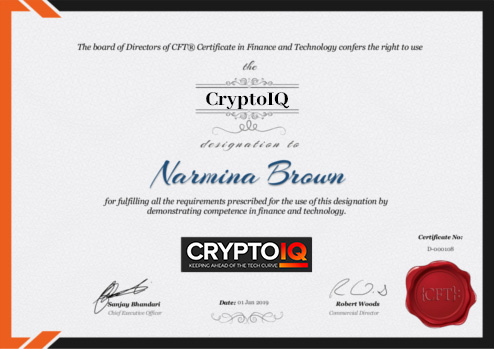

This program is designed to help you future-proof your career by giving you access to knowledge around cryptos, broken down into easy to digest chunks. We ensure that you become up to date with the latest trends impacting the industries right now.

Regardless of whether you work in a tech role or not, it’s vital that you have a working knowledge of the concepts covered in this program, as every industry is now starting to explore of some of this technology.

Not only will you have the power to innovate and create better solutions, you will become DigitalIQ certified once you complete the final assessment.

This programme is for anyone who would like to know more about the role of ESG within investing or how ESG can be integrated within investing. It is designed especially for those who may then go onto taking the CFA Certificate in ESG Investing exam. This exam is especially suited to: Investment practitioners, sales and distribution workers, asset managers, financial advisors, business consultants and risk managers.

There are no prerequisites required.

The Certificate in ESG Investing is administered and awarded by the CFA institute and can be booked here.

The Echios learning portal with all materials will be available within 24 hours of signing up to the course.

The Echios course can be used as a revision tool, and you will gain access to our learning videos and the entire question bank upon signing up. However, the CFA training manual is only provided once you have registered on their site for their exam. You will have 12 months to sit the exam after registration. You can register here.

The recommendation given by the CFA is 130 hours of study time for this exam

No. Whilst the course is designed especially for those taking the exam, it can also be used to learn more about ESG and can be used as part of your CPD. You are to enrol separately if you wish to register and sit the CFA exam.

All of your training is online and you will have access to the slides, interactive learning videos, the entire question bank to prepare you for the exam and also access to an online help desk.

Through any internet browser and also through iOS and Android apps. Your progress will be synchronised across all devices.

This will depend on the market in which you are sitting the exam. This certificate is not currently available in a number of markets, including China. The exam can be taken based on the availability of the centre and online proctoring is also available in certain markets. You can get further information on the CFA website here.